The Power of Backtesting

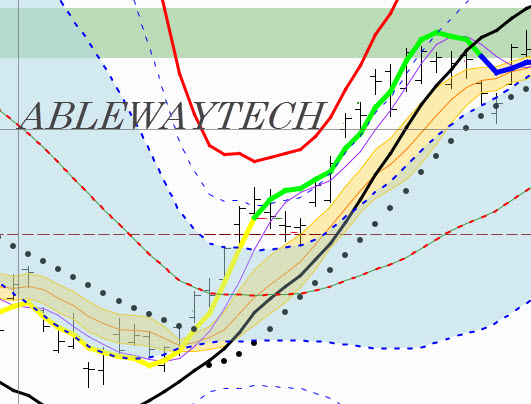

The purpose of this article is to make the strongest case possible for back-testing as a crucially important way of understanding your system. In other articles I will suggest that too much back-testing is bad and that you can learn too many wrong lessons if you’re not careful. That said however, back-testing is an essential part of a complete trading plan.