Join Our Thriving user group: OBUG

The Owl Bundle User Group (OBUG) is a dynamic and supportive community of passionate traders who meet weekly via Zoom to explore the intricacies of the market. Our primary focus is on the continuous development and refinement of trading systems using Thinkorswim and EdgeRater. Each session is a hands-on experience, blending theory with practical application, ensuring that members gain actionable insights and sharpen their trading skills.

MEMBER TESTIMONIAL

“The OBUG group and the Applied Swing course have been outstanding, and the content continues to excel. One has to appreciate the instructors going above and beyond to bring all the insights together into strategies we can incubate,and to provide guidance on the nuances of which filters and exits to use for which objectives or under which conditions...” DB

Why Join OBUG?

Collaborative Learning: Engage with experienced traders who share your dedication to Dr. Ken Long’s methodologies. Our weekly Zoom meetings provide a platform for mutual learning and the exchange of advanced trading techniques using EdgeRater and Thinkorswim.

State-of-the-Art Tools and Techniques: Master the use of powerful tools like EdgeRater for backtesting and Monte Carlo analysis, and develop custom indicators on Thinkorswim based on Dr. Ken Long's methodologies. We guide you from basic tutorials to sophisticated strategies and multifactor analysis.

System Development and Optimization: Focus on the ongoing enhancement of trading systems. We rigorously analyze backtest results, optimize parameters, and perform Monte Carlo simulations to ensure your strategies are robust and effective.

Diverse Topics and Insights: Each meeting covers a wide array of subjects, providing a holistic understanding of various trading aspects. From market scans and strategy backtests to exit strategies and system development, our discussions are thorough and insightful.

How to sessions: Included are regular educational sessions on how to backtest, run Muiti-Factor Analysis, Batch Testing, Monte-Carlo Analysis using Dr Ken Long’s Swing Templates.

Explore the Critical States Template

Are you looking to deepen your understanding of market dynamics and uncover actionable insights? Our upcoming 12-week series in the Owl Bundle User Group (OBUG) is dedicated to an in-depth study of Dr. Ken Long's Critical States Template.

What You'll Gain:

A structured approach to studying the Critical States Template, including identifying market movers and understanding the key levers of its filters.

Backtest results and analysis showcasing the capabilities and limitations of the Critical States Template.

Practical insights into using the Critical States Template for swing and intraday trading decisions.

Key Topics Covered:

Overview of the Critical States Template

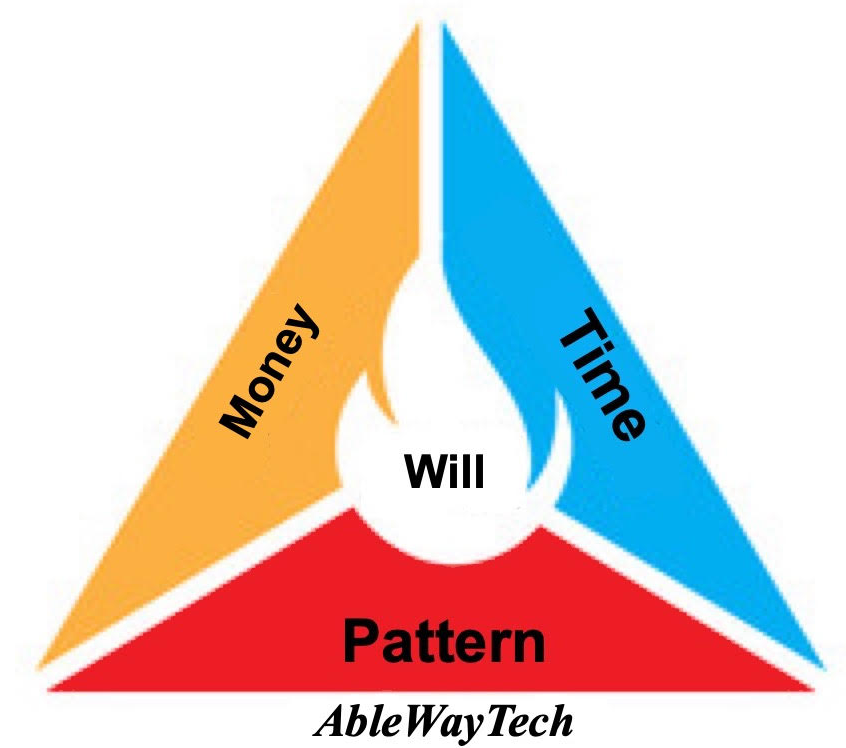

Understand the theory behind the Critical States Template and its Triple Factor Framework (Location, Volatility, Path) for identifying market imbalance.Backtest Study Results

We will share curated backtest results, analyzing symbol selection, multi-factor triggers, and exit strategy optimizations.Reverse Engineering Abnormal Moves

Study historical patterns to uncover conditions leading to significant market moves and how to use these insights to inform trading decisions.Strategy Robustness and Optimization

Explore the results of walkforward testing, Monte Carlo analysis, and multi-factor testing to evaluate the robustness of the strategy.Practical Applications of Critical States Filters

Use the shared results to develop actionable strategies for your trading portfolio.

Critical State Template to “Find the Movers”

While we will not teach how to run backtests, we will share the backtest and analysis results, providing insights into the framework’s strengths, weaknesses, and potential applications. For those interested in running their own backtests, a separate step-by-step guide is available in our tutorial module in OBUG.

Join Today!

All sessions are recorded for your convenience, ensuring you can revisit key insights or catch up if you miss a session. Enroll today using this LINK.

*** TUTORIAL ****

Step-by-Step Backtesting with EdgeRater

A step-by-step guide on trade simulation and backtesting using EdgeRater on Dr. Ken Long's trading strategies. It is designed to guide you how to backtest, conduct multifactor analysis, optimize parameters, and perform Monte Carlo analysis. The intent is to equip you with the knowledge to conduct your own trade simulations and backtests.

Objectives:

Understand EdgeRater's Simulation and Backtesting Capabilities: Gain a comprehensive understanding of how to set up and operate simulations and backtesting within EdgeRater, exploring its full range of features.

Apply Trading Strategies in Simulated Setups: Implement the trading strategies you've learned in simulated setups to evaluate their performance under diverse market conditions.

Analyze Backtesting and Simulation Results: Learn to effectively analyze the outcomes of your simulations and backtests to make informed decisions about strategy adjustments and refinements.

Scope:

Setting Up Simulations and Backtests: Detailed instructions on configuring EdgeRater for both trade simulations and backtesting, including how to select parameters and analyze different scenarios.

Running Simulations and Backtests: Step-by-step guidance on conducting simulations and backtests, featuring examples from common trading scenarios using Dr. Ken Long’s systems.

Result Analysis: Techniques for interpreting the results of trade simulations and backtests, focusing on performance metrics and areas for strategic improvement.

Practical Exercises: Engage in hands-on exercises that enable you to simulate and backtest trades using both pre-defined and custom strategies, aimed at reinforcing learning and building operational confidence.

Intent:

Participants will not only understand the theoretical aspects of trade simulation and backtesting but also be able to apply these concepts practically, providing a solid foundation for advanced trading strategy development.

OBUG Market Condition Analysis View

OBUG RiskZ View

OBUG Market Regression LIne Slope Zscores

OBUG Sector Rotations Views

Contact admin.support@ablewaytech.com on question.