The purpose of this blog post is to provide information that can help in Core trading. To make informed longer-term trading decisions, one can use the "three-factor model" framework, which includes the Market Factor, Sector Factor, and Company-specific factor.

Find the movers 2/24/2023: NKE and TSLA

When using the Owl Bundle on Thinkorswim to identify trade opportunities, we adopt a "Logic chain" approach that involves analyzing sectors and the symbols within them. To do this, we examine the S&P500 sector ETFs and rank them according to Rstat/MyRisk from highest to lowest. In our analysis, XLY, XLK, and XLC emerged as the top three symbols

Adapting to a Dynamic Market

Trade the Way Ted Williams Hit Baseballs

Ten Ways to Find New Edges

If you want to find opportunities in the market that no one else can see, then you must admit to looking at the market in a different way than the herd. In practical terms this can mean doing things like: The minute you stop searching for new ideas and new ways of expressing your edge, is the minute that the pack is gaining on you.

Dual portfolio approach to my Investment Strategy

My investment strategy is a dual portfolio approach, which involves maintaining a long-term, low-risk portfolio for stability and growth, and a separate short-term trading portfolio focused on generating short-term returns. This allows me to balance the security provided by the long-term portfolio with the potential for higher returns from the trading portfolio.

Designing a Robust Trading System

Sensitivity Analysis of Trading Strategies on Thinkorswim

Understanding Average True Ranges ATR

Developing the Daily Trading Plan

Trading the markets on a daily basis with short term strategies places a premium on efficiently and effectively developing a comprehensive daily trading plan. Short term trading can be a very rewarding part of an overall trading and investment strategy. Without a sound and comprehensive plan, though, there are just too many ways to go astray for the novice trader.

Weekly Macro View and Market Analysis Newsletter

KELLY CRITERION Ed Thorp Optimal Position Sizing for Stock Trading

Creativity 202: Wrap up Lesson 30, Ken Long course

Van Tharp Trade Your Way to Financial Freedom - Expectancy in Trading & Position Sizing

Dr Van Tharp (Featured in market wizards) looks at stock trading from a probabilistic perspective, discussing the expectancy value measured in multiples of R and highlighting the importance of position sizing. Dr Tharp says most traders are looking for the holy grail of stock trading within a particular setup, when in reality the way to trade your way to financial freedom is to look within yourself. Managing your risk through position sizing, using the risk reward ratio and controlling your inner self (trading psychology) are keys to your stock trading success. The expectancy value should also be aligned to opportunity, expectancy without opportunity could lead to minimal profits.

The Power of Backtesting

The purpose of this article is to make the strongest case possible for back-testing as a crucially important way of understanding your system. In other articles I will suggest that too much back-testing is bad and that you can learn too many wrong lessons if you’re not careful. That said however, back-testing is an essential part of a complete trading plan.

Backtesting your trading skills with Thinkorswim OnDemand

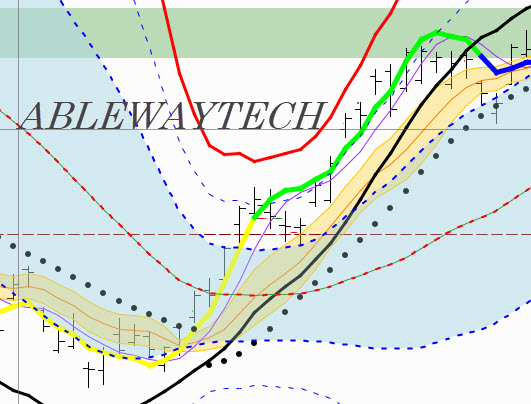

This blog will describe how to evaluate your trading skills through Thinkorswim OnDemand features. The Thinkorswim OnDemand allows you to move back in time to do simulated trades using all your trading indicators and setups. Thinkorswim has stored all the historical price and options data for the last decade that allows you to practice your trades with tick, minute, daily, weekly, or monthly timeframes.

Appreciating the art and science of trading

In any profession that features a strong human performance factor, there will surely be a mix of both art and science that contributes to the final product and performance level. Since the trading profession incorporates such a large amount of human psychology at both the individual and organizational level, it’s worth considering how both art and science are reflected in your own trading practice. It’s also good to know how strong you are in both dimensions so that you can insure you leverage your strengths while protecting your weaknesses.

Backtesting strategies on Thinkorswim desktop

So, you have a trading strategy and are wondering how it would perform, or you may wonder which exit approach is best for your trading strategy. Thinkorswim “Strategies” is a back-testing capability to provide you with historical buy and sell signals on your chart based on your strategy rules, as well as provide a graphical and table report that shows the hypothetical profit/loss of your trading strategy.