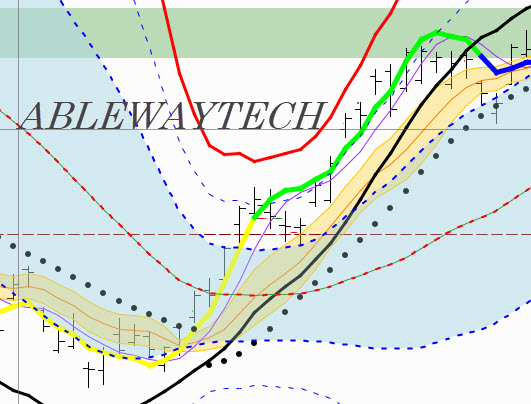

The first task of technical analysis is to identify trends in market price movements. The second task is to identify turning points. Technical Analysis focuses on trend detection because whatever has been happening in the past tends to continue happening. As Tony Sagami puts it, "…trends in motion tend to keep moving until they’ve run their course." In the markets, trends continue until there is a shift in the expectations of the market participants. That is when identifying turning points becomes important.

Mastering the Art of Trading Systems

Across the following ten chapters, we will delve into various facets of trading systems, equipping you with the knowledge and tools needed to navigate the complexities of modern trading. Whether you are an aspiring trader seeking to embark on your trading journey or an experienced trader looking to refine your existing strategies, this guide offers valuable insights and practical advice to help you master the art of trading systems.

Information Sources for Core Trading

Dual portfolio approach to my Investment Strategy

My investment strategy is a dual portfolio approach, which involves maintaining a long-term, low-risk portfolio for stability and growth, and a separate short-term trading portfolio focused on generating short-term returns. This allows me to balance the security provided by the long-term portfolio with the potential for higher returns from the trading portfolio.

Weekly Macro View and Market Analysis Newsletter

KELLY CRITERION Ed Thorp Optimal Position Sizing for Stock Trading

Creativity 202: Wrap up Lesson 30, Ken Long course

Van Tharp Trade Your Way to Financial Freedom - Expectancy in Trading & Position Sizing

Dr Van Tharp (Featured in market wizards) looks at stock trading from a probabilistic perspective, discussing the expectancy value measured in multiples of R and highlighting the importance of position sizing. Dr Tharp says most traders are looking for the holy grail of stock trading within a particular setup, when in reality the way to trade your way to financial freedom is to look within yourself. Managing your risk through position sizing, using the risk reward ratio and controlling your inner self (trading psychology) are keys to your stock trading success. The expectancy value should also be aligned to opportunity, expectancy without opportunity could lead to minimal profits.