Owl Bundle User Group (OBUG) is focused on fully systematic trading based on Dr Ken Long’s trading strategies, using EdgeRater as the engine for research, validation, and backtesting. This allows us to study trading strategies with precision, quantify edges, and develop durable trading systems that work across market conditions—not just in theory, but in practice.

GLD at Full Throttle: How Long Can This Bull Run Last?

Short-Term Analysis of GLD

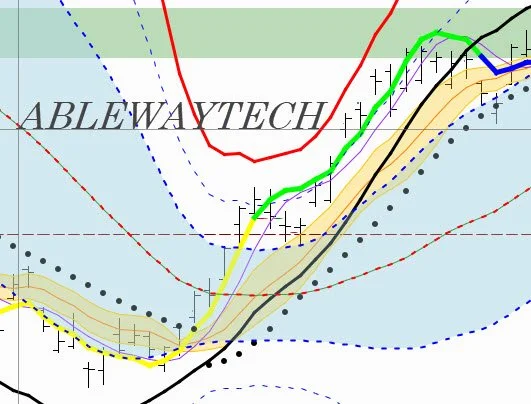

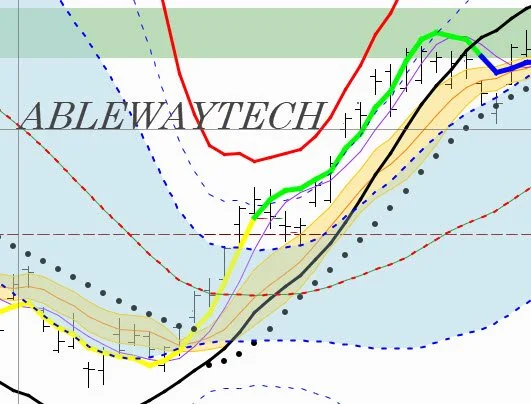

The recent weekly dojis are seen more clearly the daily chart. The 20-period SMA has gone sideways, and price has gone from ‘walking the band’ for two months to a pullback below the support of the 20-day SMA. Volatility has decreased as well as the Bollinger bands have narrowed.

GLD: Searching for Early Signals Before Gold’s 6% Drop

When GLD collapsed 6 percent on October 21 2025, it caught the financial media by surprise. Inside OBUG — the Owl Bundle User Group — we weren’t trying to predict the crash; we were trying to understand whether the market had warned us.Could the clues have been visible earlier — in volatility, sentiment, or price structure — using Dr. Ken Long’s regression-line analytics?

Unleashing the "Godzilla" Strategy: A Critical State Filter to Find the Movers

At AbleWayTech.com, we’re exploring robust trading methodologies to help our community understand market dynamics. One standout method we’ve studied in our Owl Bundle User Group (OBUG) is the Godzilla strategy, based on Dr. Ken Long’s techniques. The EdgeRater tool allows us to scan and backtest the Godzilla strategy. The motivation behind Godzilla is simple: find the movers—symbols most likely to make sharp, outsized moves. While most stocks churn quietly, Godzilla is designed to isolate those rare moments of imbalance when institutions are forced to act, creating powerful short-term opportunities.

IYR at a Crossroads: Triangle Consolidation and the Push Toward 100

EWW Technical Outlook: Bullish Breakout Signals and Price Targets Ahead

Owl Bundle User Group (OBUG) Weekly Insights

In our weekly Owl Bundle User Group (OBUG) sessions we review the current market conditiona and backtest trading strategies to identify and validate edges. OBUG is where we take Dr. Ken Long’s trading indicators, stress-test them in EdgeRater, and uncover insights for active traders. Here’s a preview from this week’s meeting:

Assessing Market Regime with RL30Slope & RiskZ – OBUG Market Scan (June 13, 2025)

At AbleWayTech, the Owl Bundle User Group (OBUG) continues to refine its edge-driven approach by integrating Dr. Ken Long’s technical frameworks into a structured logic chain of market interpretation. In our June 2025 OBUG Meeting 119, we applied slope-based analysis across macro regimes, asset classes, and sectors to identify key inflection points and regime transitions.

How We Decode the Market Each Week — Inside the Owl Bundle User Group (OBUG)

Welcome to the Owl Bundle User Group (OBUG) — a live, weekly session hosted by AbleWayTech, where we dive deep into Dr. Ken Long’s powerful trading frameworks through structured backtesting studies, helping members gain a richer, data-driven understanding of market dynamics and strategy development.

Owl Bundle User Group (OBUG) March–April 2025 Update

At AbleWayTech, we believe great trading is not built on luck —it’s built on data, structure, and edge awareness. At our Owl Bundle User Group (OBUG), we systematically backtest and analyze Dr. Ken Long’s trading methodologies and techniques to better understand trading edges — and to build a library of non-correlated trading systems. Using advanced tools like EdgeRater and Thinkorswim, we rigorously analyzed, backtested, and stress-tested strategies across multiple timeframes, market regimes, and asset classes. Here’s a look at what we explored over the past two months (March–April 2025):

Trading Edges with RL30Slope Z-Scores: What the Backtests Say

At AbleWayTech, we believe great trading isn’t the result of luck — it’s built on data, structure, and edge awareness. That philosophy was front and center in our latest Owl Bundle User Group (OBUG) Meeting 111, where we revealed the results of our deep-dive study on regional ETF market behavior using 15-year backtests powered by EdgeRater.

Owl Bundle User Group (OBUG) – 1Q2025 Update

Are you ready to trade smarter with a community that thrives on strategy, structure, and shared learning?

If you're serious about deepening your understanding of market systems and want to apply Dr. Ken Long's data-driven trading strategies, then OBUG (Owl Bundle User Group) is where you belongWe are a weekly mastermind of traders, students, and system developers dedicated to building and refining robust trading systems using the tools and principles taught by Dr. Long.

Owl Bundle User Group (OBUG) – Activities Update (Dec 2024 – Feb 2025)

Over the past few months, the Owl Bundle User Group (OBUG) has been studying systematic trading strategies, focusing on Dr. Ken Long’s Critical States Template using the EdgeRater platform. With weekly sessions on backtesting, market analysis, and strategy refinement, we’ve been on a quest to uncover market edges and fine-tune our trading systems

OBUG Meeting Recap Example: February 2, 2025

Our February 2nd 2025 Owl Bundle User Group (OBUG) meeting was an insightful deep dive into advanced trading methodologies inspired by Dr. Ken Long. We explored market scans, critical state setups, and compared different signal-based trading strategies. Below is a detailed breakdown of our discussions and key takeaways.

Intraday Trading Tips: Using Daily Lows to Secure Your Stops

Having to accept our stops being hit is a part of trading. It’s true. But let’s do our best to protect those stops so they don’t get hit as often. In this article, I’d like to explore this concept of protecting our stops with a support level that I think has a lot of benefits.Specifically for intraday, the low of yesterday’s session can be a great stop protector.

Explore Dr. Ken Long's Critical States Template: A Study with the Owl Bundle User Group Sessions

Are you ready to deepen your understanding of trading systems through comprehensive analysis and collaborative discussion? Join the Owl Bundle User Group (OBUG) for the next 12 weekly sessions as we study Dr. Ken Long's Critical States Template. These sessions aim to explore the framework, uncover its levers, and understand its capabilities and limitations.

Two Signals are Better Than One: Confluence and Confirmations in Trading Signals

Trading is essentially a game of probabilities. While we can’t predict what will happen, we can seek situations where the odds are stacked more in our favor. One of the biggest takeaways I’ve had from my studies at the Society of Technical Analysis is the importance of finding confirmation or confluence of different market conditions to inform our decision-making.

OBUG 4Q2024 Summary: Advancing Systematic Trading Strategies

The Owl Bundle User Group (OBUG) had an engaging fourth quarter of 2024, scanning the markets for the week ahead, strategy backtesting, and collaborative learning. Using tools like EdgeRater and the ThinkorSwim backtester, we worked to gain a deeper understanding of Dr. Ken Long’s methodologies by systematically exploring their strengths, edges, and limitations. With 93 weekly recorded OBUG sessions to date plus 10 dedicated tutorials on backtesting with EdgeRater, we continued to refine our trading expertise through data-driven approaches. This quarterly summary highlights our market analysis using Dr. Long's 30-period Regression Line Slope Z-scores, and the insights gained from our backtest studies.

Owl Bundle User Group Meeting Recap: Strategy Ranking and Key Insight

In our recent Owl Bundle User Group meeting, we explored the ranking of our 26 different trading strategies, focusing on identifying those that offer the best risk-adjusted returns, robustness, and consistency. This analysis is based on Dr. Ken Long's methodologies and was conducted using backtesting results from SPY, covering the period from January 1, 2010, to October 28, 2024. We utilized EdgeRater for backtesting and statistical analysis to ensure comprehensive evaluation and reliability of the results.

Building a Portfolio of Non-Correlated Strategies: Insights from Our Latest OBUG Correlation Study

At AbleWayTech, our Owl Bundle User Group (OBUG) brings together traders seeking to sharpen their skills and diversify their strategies. Our members follow Dr. Ken Long's trading methodologies and techniques. In our recent session, we conducted an in-depth correlation analysis to determine how to best achieve a smoother equity curve and minimize drawdowns through the use of non-correlated trading systems. Here, we share some key findings.