The Owl Bundle User Group (OBUG) is an active community of enthusiastic traders who follow Dr. Ken Long’s trading methodologies. We gather weekly to analyze market trends, optimize trading strategies, and share valuable insights that help us navigate the complexities of trading. Here’s a snapshot of what our typical meetings entail and why you might want to join our group.

What We Do

1. Market Scan:

Each session begins with a scan of the markets. We examine overall market conditions, delve into specific sectors, and analyze individual symbols. This detailed look helps us gauge the pulse of the market, setting the stage for informed trading decisions.

2. Backtest studies Using Edgerater

At OBUG, we utilize EdgeRater to backtest various strategies based on Dr. Ken Long's Owl trading indicators and methodologies. Below are some examples of the strategies we've studied:

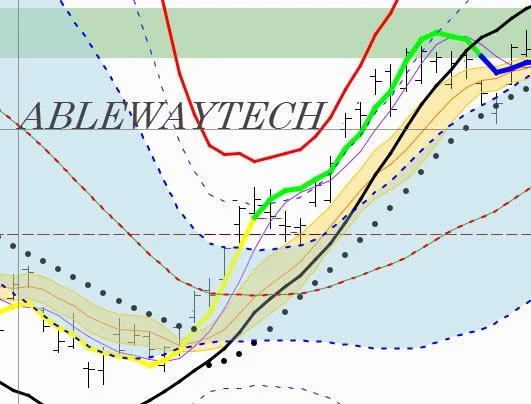

Swing Systems with PSAR Flip Strategy: We tested the Parabolic SAR (PSAR) flip strategy using the Dow30 and SPY under different market conditions.

Market Classification Analysis: Utilizing the RL30 and SMA30 on SPY and the Dow30 symbols, we evaluated how market classification impacts strategy performance. This backtest helped us better understand which market environments our strategies are best suited for.

Multi-Factor Analysis on Ken's Swing Systems: We conducted a thorough multi-factor analysis using a 1000-case Monte Carlo simulation. This analysis focused on symbols to identify which components contributed most to successful outcomes.

Sector Slope Studies: We expanded our analysis to sector slopes, investigating the Zscores of the RL10, RL30, and RL90 slopes. This helped us ascertain potential setup conditions across different sectors, improving our ability to time entries and exits more effectively.

Use of Adaptive Exits: Use of NDX, Keltner, Bollinger Bands, PSAR, ConnorsRSI, BabyDragon and others on the Swing Systems rules.

Strategy backtesting to compare daily, 3-day, and 9-day results.

These sessions not only refine our strategies but also enhance our understanding of market dynamics, so that all members of OBUG can apply these insights to real-world trading scenarios.

3. Demonstrations:

Understanding is key to application. That's why our meetings include demonstrations on how these backtests are conducted. Whether it's setting up the EdgeRater software, tweaking parameters, or interpreting the results.

GET UP TO SPEED

Join us for a two day Applied Swing Trading Course on July 20 and July 28th from Noon - 6 PM EST. This course will cover Dr Ken Long’s trading process, how EdgeRater is used for Scan and backtesting of Dr Ken Long’s Swing Systems Template, and the practical applications of Dr Ken Long’s Swing Template in trading. Then consider joining our OBUG group for further in depth studies towards your trading journey as as self directed trader! More information can be found HERE.