by Philp Wu in collaboration with Dr Ken Long, Chris White, Griffin Cooper

Introduction:

In the ever-evolving landscape of trading, having the right tools at your disposal can make all the difference. The Owl Bundle User Group has recently started to use the EdgeRater tool to compare various trading strategies and deterimine their respective edges. EdgeRater is a versatile software application that scans for trading opportunities, conducts strategy backtesting, enables in-depth chart analysis, optimizes rule parameters, performs Monte Carlo analysis, and conducts multi-factor analysis. This article delves into this collaboration and explores the capabilities of the EdgeRater tool through the lens of the recently developed Ken Long templates - the Swing Systems and Critical States templates.

Evolution of Engagement:

The collaborative effort between Dr. Ken Long and Chris White from EdgeRater began in October 2022. By February 2023, the Critical States template was available for testing, followed by the Swing Systems template in September 2023. Currently, the Ken Long templates are in the beta testing phase for the next version of EdgeRater, with plans for release before the end of the year 2023.

EdgeRater Scanning for trades:

The initial collaboration lies in the development of two Ken Long templates by EdgeRater: Swing Systems and Critical States. Figure 1 below displays the scan results from running the Swing Systems and Critical State Scans templates.

Figure 1 - Swing Systems and Critical State Scan results of S&P500

Traders are able to view charts associated with symbols meeting the various setup conditions. For example, Figure 2 shows HBI as meeting the 5DD setup conditions and the corresponding bar in the chart. This enables traders to analyzed technical aspects such as support, resistance, and target levels.

Figure 2 - HBI 5DD setup conditions met and the corresponding point on a chart

Unveiling the Backtest Results:

The EdgeRater tool empowers users to conduct comprehensive backtesting, As an illustrative example, the backtest of the Swing Systems’ 5DD strategy on SPY, provides insights into its performance on the daily timeframe. Figure 3 illustrates, the 5DD strategy has a 73% win rate, an Average Profit/Loss % of 3.2%, and a Profit Factor of 3.7. This backtest also shows opportunities for further improvements as will be discussed later.

Figure 3 - Swing Systems 5DD backtest results

Charting Analysis

The EdgeRater tool provides a detailed trade list from backtesting and allows viewing the trades on the chart, offering a holistic view of the strategy's performance. Figure 4 shows a trade on SNA on 12/22/2020 and the corresponding view on the chart at the entry and exit points.

Figure 4 - 5DD Tradelist and corresponding view on the chart

Multi-Factor Trade Analysis:

EdgeRater's multi-factor analysis adds sophistication to strategy evaluation. By assessing market conditions, traders can determine when a strategy is most effective. In the case of the 5DD strategy, the analysis reveals a preference for bearish market conditions. Figure 5 compares the 5DD strategy with no market condition filter versus 5DD strategy in a bearish market condition. With a bearish market condition filter the 5DD strategy shows a better risk adjusted return, with higher Average Profit/Loss %, a higher expectancy, and a higher profit factor.

Figure 5 - 5DD strategy performance without and with a market condition filter

Owl Bundle User Group Meetings:

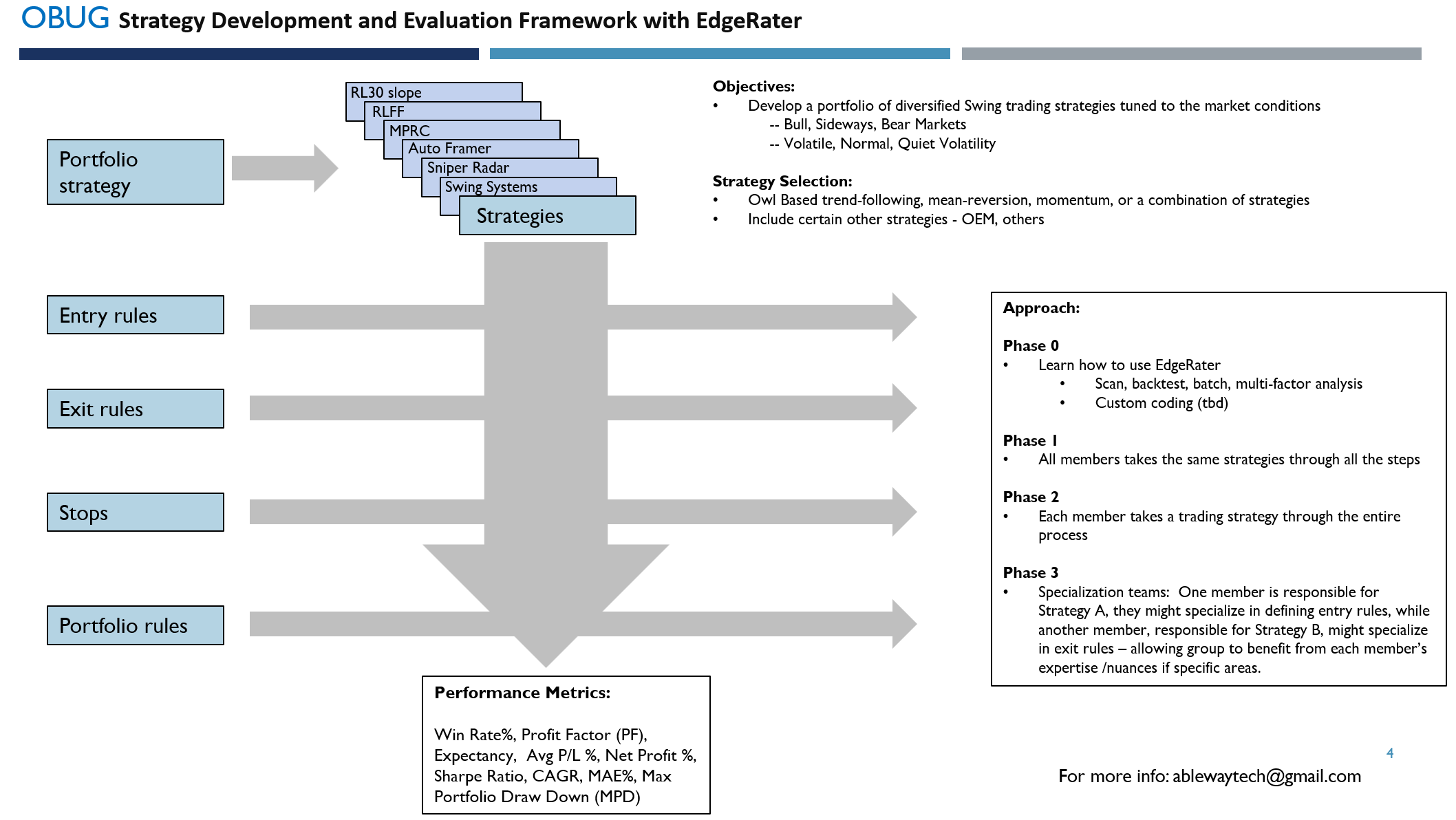

The Owl Bundle User Group is launching a series of meetings on the practical application of EdgeRater. These sessions will guide participants through the process of developing a diversified portfolio of Swing trading strategies tailored to varying market conditions using the EdgeRater tool. Figure 6 illustrates our project staged into 4 phases, starting with learning the basics in Phase 0 and progressing to specialized teams in Phase 3.

Figure 6 - Using EdgeRater to help develop a portfolio of strategies

Trading Execution Techniques

The EdgeRater tool empowers traders to identify potential trading edges across diverse market conditions. The actual execution of trades, viewed from a reward-to-risk perspective, as well as considerations for risk management, money management, and post-trade analysis, can be further refined using Kata Challenge techniques as taught in our Applied Systems Development Course. By integrating the insights gained through EdgeRater's backtesting with our course’s Plan-Prepare-Execute-Assess process, you can elevate the overall effectiveness of your trading strategies and optimize the reward-to-risk ratio of your trades

How to Join the Owl Bundle User Group:

For those eager to elevate their trading game, the Owl Bundle User Group welcomes new members. To learn more and become a part of this exciting journey, reach out to admin.support@ablewaytech.com. Also, a special discount offer is available for those interested in purchasing the EdgeRater tool: https://edgerater.com/ablewaytech

Conclusion:

The EdgeRater tool, with its scan and multifaceted analysis capabilities, is proving to be a game-changer for the Owl Bundle User Group. As we embark on this journey of strategy development and evaluation, the collaboration will unlock new dimensions of success in trading systems development.

Happy Trading!