15 years of data across 7 global ETFs reveal where mean reversion thrives and momentum fails.

The Quest for Alpha, One Heatmap at a Time

At AbleWayTech, we believe great trading isn’t the result of luck — it’s built on data, structure, and edge awareness. That philosophy was front and center in our latest Owl Bundle User Group (OBUG) Meeting 111, where we revealed the results of our deep-dive study on regional ETF market behavior using 15-year backtests with EdgeRater.

This wasn’t just another indicator study — it was a multi-regime, multi-horizon quantitative analysis of global equity markets using the RL30Slope Z-score, an advanced price slope momentum indicator developed by Dr. Ken Long to quantify trend acceleration and regime shifts with statistical precision.

Study Objective: Where is the Edge?

The core question behind our research: Which market regimes offer the greatest edge for swing trading across regions? We applied this question to seven major ETFs representing global equity regions — including the U.S. as a reference benchmark:

EFA – Developed Markets ex-US

IEV – Europe

EWJ – Japan

EPP – Asia Pacific ex-Japan

ILF – Latin America

EEM – Emerging Markets

SPY – U.S. (as a comparative baseline)

Each ETF was analyzed using:

RL30Slope Z-scores at entry (from +3 to -3 sigmas)

Holding periods: 3, 5, 10, and 15 days

FE50 outcomes (Final Equity / Starting Equity at the 50th percentile)

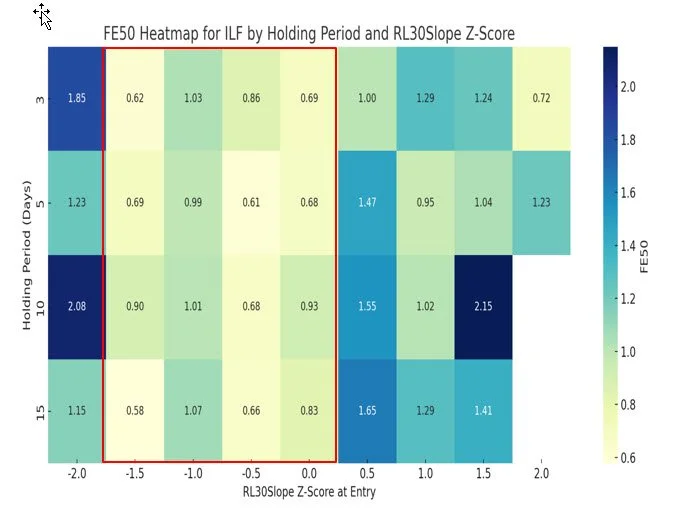

Figure 1.0 below is an example of the Heatmap analysis for ILF the Latin America ETF:

Z < -2.0 → Strong mean reversion signals; price often rebounds sharply

Z = +0.5 to +1.5 → Continuation trades fueled by institutional momentum

Z between -1.5 and 0.0 → Low-conviction zones; prone to sideways chop (red box)

Figure 1: RL30Slope Zscore Analysis on ILF - Latin Americal ETF

We analyzed all 7 regional ETFs in this manner with results shown in Figure 2.

Figure 2: RL30Slope Zscores on SPY, EFA, ILF, EWJ, IEV, EPP, EEM

Key Takeaways: Where Alpha Lives

Z = -2.0 to -1.5 sigmas is the universal sweet spot

This zone represents deeply oversold conditions followed by slope reversal — ideal for mean reversion swing trades with high expectancy.

Z = +1.5 is your momentum breakout zone

Strong upward slopes + institutional follow-through = continuation setups that favor trend trades.

Trap Zones (-1 < Z < +1)

Price lacks conviction. These are the “drift zones” — low expectancy, high noise. Great for tourist traders. Not for us.

Global Macro Implications

Certain ETFs behaved differently based on macro capital flows:

EEM and EPP weren’t momentum-driven.

These instruments react best to panic-buying reversals, not strength chasing.

This underscores a key insight:

“Not all instruments respond the same way to the same signals.”

Portfolio Optimization in Action

This Z-score matrix allows traders to:

Avoid low-expectancy trade zones

Allocate capital by regime and conviction

Tailor holding periods to volatility conditions

Use data-driven filters to deploy trades with greater precision

This is not just technical analysis — it’s edge-aware, regime-adaptive trading

Join the Owl Bundle User Group (OBUG)

If this level of rigor, insight, and collaboration excites you — don’t trade alone. Join the Owl Bundle User Group (OBUG) traders gather to build:

Robust systems based on statistical backtests

Backtested frameworks designed for risk-adjusted returns

Non-correlated strategies for smoother portfolio equity curves

Join us today at www.ablewaytech.com/obug

Disclosures: All OBUG materials are for educational purposes only. This is not investment advice. See full disclaimer at the bottom of this page.